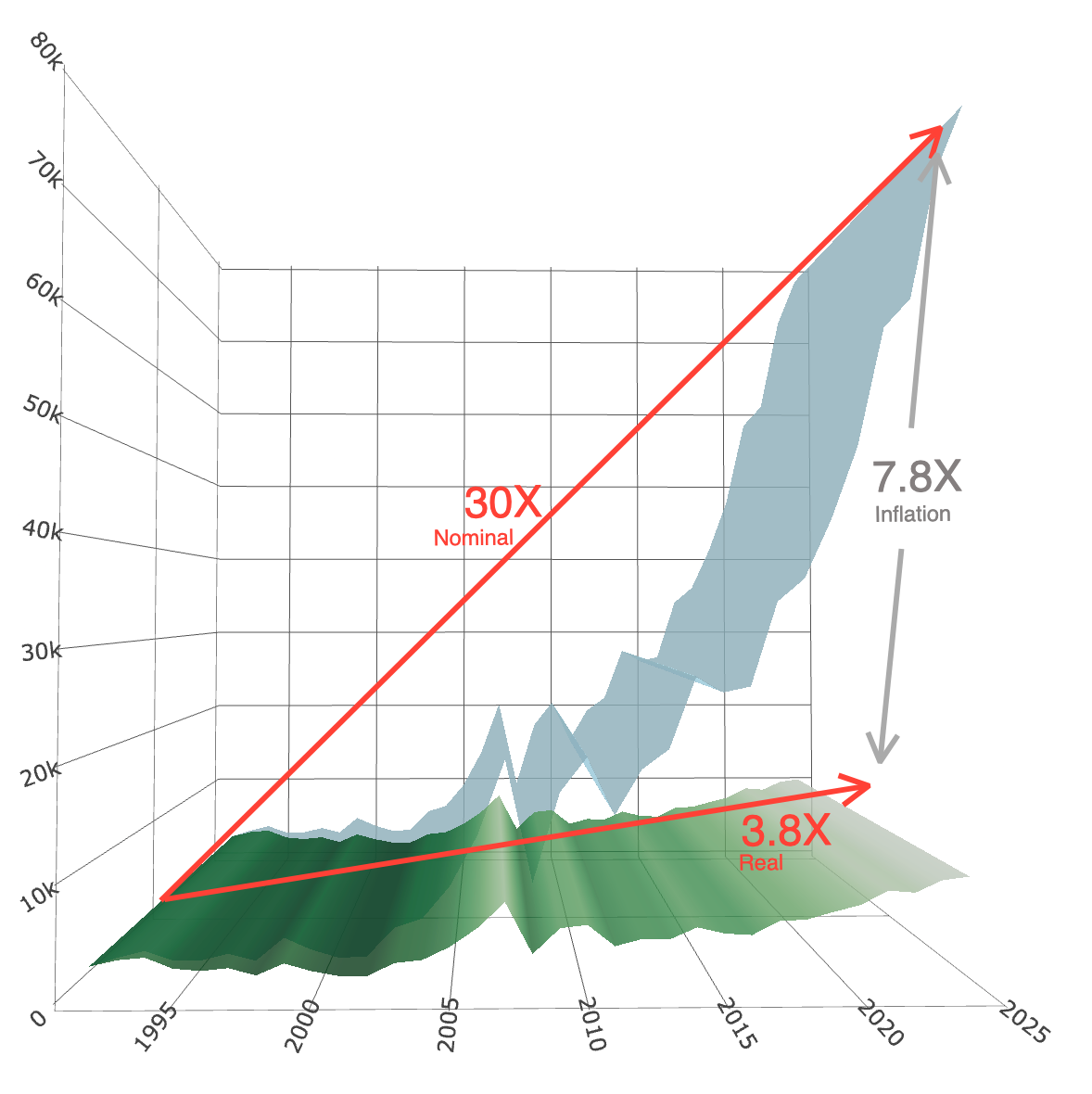

Real Returns After Inflation

Previously, we charted the Indian market's spectacular rise—a headline grabbing 33× increase from 1992-2025. In this post we investigate how much of that rise did investors keep after inflation.

Historical Returns & Inflation

The table below details annual inflation and the Sensex from 1992–2024. Note the long stretches of double‑digit inflation in India.

For each year, we deflate the Sensex by that year’s CPI to express the index in 1992 rupees. On the surface, the Sensex rose from ~2,500 in 1992 to ~78,000 by end‑2024—a ~30× increase, or an 11.2% CAGR. After adjusting for inflation, the increase is ~3.83× (to ~10,000 in 1992 rupees), a 4.57% CAGR.

The 6.63% gap between nominal and real CAGRs reflects the average inflation drag over the period.

Returns for Key Periods

- 1990s: A washout in real terms—nominal gains were erased by high inflation.

- 2000s: Strong real returns with moderate inflation; 2003–2007 delivered the fastest real growth on record.

- 2010–2020: Another weak decade in real terms—subpar nominal returns alongside persistent inflation.

- 2021–2024: A shift—inflation nearer 5% and market returns closer to long‑run averages, lifting real gains.

(use this calculator to calculate real returns for different growth rates, time frames and inflation scenarios)

A Leak in the Bucket

Inflation is a steady leak, draining real wealth. The loss compounds and is irreversible: once purchasing power is gone, future returns must first refill the hole before creating new real gains. In effect, investors have to keep running just to stay in place.

"The arithmetic makes it plain that inflation is a far more devastating tax than anything that has been enacted by our legislatures. The inflation tax has a fantastic ability to simply consume capital."

Takeaways

- Inflation quietly erodes real capital every year.

- Compounding cuts both ways: returns compound for you; inflation compounds against you.

- Cash and many fixed‑rate bonds often trail inflation—especially after taxes and fees.

- To defend purchasing power, investors must own assets that can outpace inflation (equities, real assets) and endure cycles.

- Expecting returns far above inflation isn’t sustainable; plan with realistic real‑return assumptions.

- Those seeking higher real returns are forced to take higher risk—more volatility, deeper drawdowns, and potential losses. There’s no free lunch.

Member discussion