Mt. Market

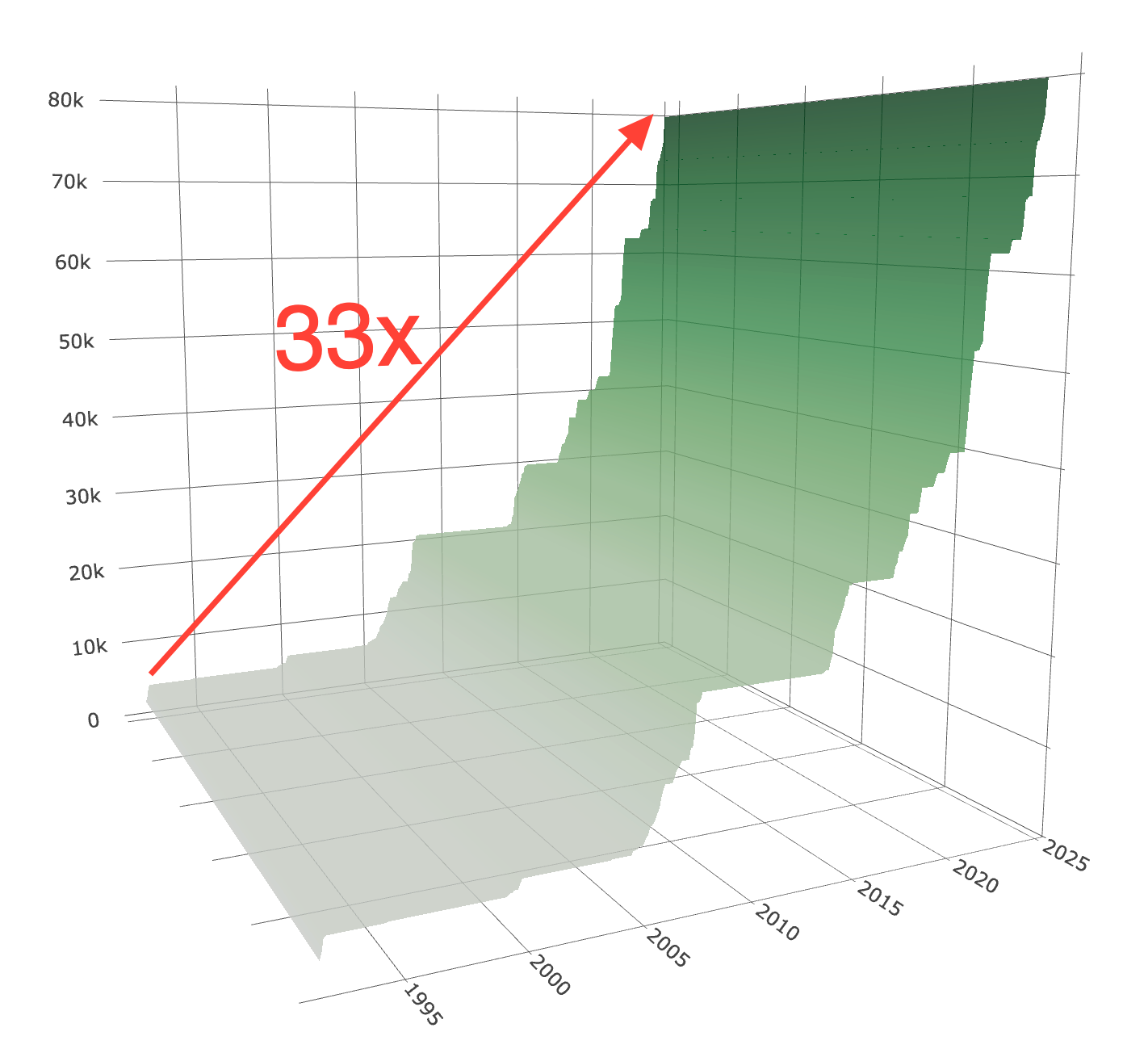

In the early 1990s, the Indian market index was at 2,500. By 2024, it had surpassed 85,000. What seems impossible can become reality over long time horizons. (At a similar growth rate, the index could reach 25,00,000 by 2055.)

Looking back across its history, the market rises like a majestic mountain range against the horizon. Each peak rises higher than the one before, forming a line that steadily ascends into the sky.

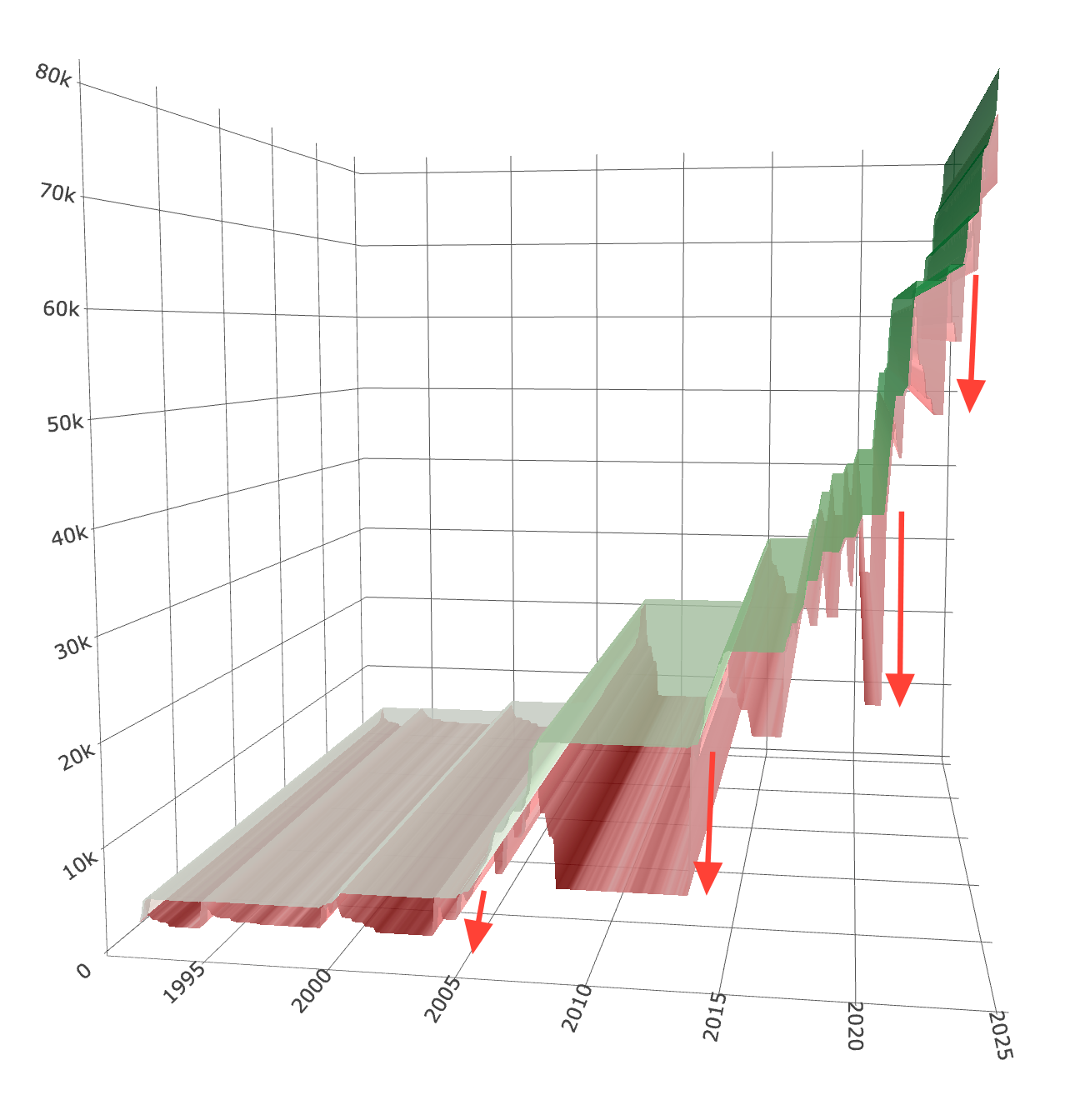

This distant perspective conceals the presence of deep valleys in between the different peaks.

For the traveler who scaled these mountains, the journey was anything but easy. The climb to each new summit required enduring valleys of uncertainty and stretches of decline. Just when the path to the next summit seemed clear, it would twist downward into deep gorges and navigate through treacherous passes.

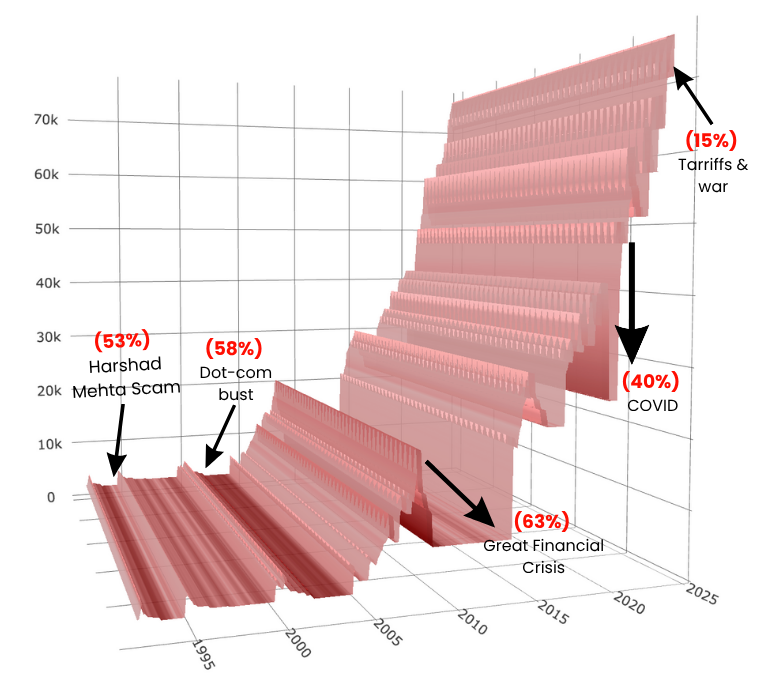

In these valleys, even the most seasoned travelers found their resolve tested. The bursting of the tech bubble in 2000 carved a 58% descent that took years to recover from. The 2008 financial crisis gouged an even deeper 63% drop, while the Covid crash of 2020 sent markets plunging 40% in mere weeks.

Those who stayed the course have reached heights they once thought impossible. From today's summit, the valleys that once seemed so daunting now appear as small dips along the journey. Those who abandoned the journey can only watch with quiet regret as the peaks rise ever higher, now beyond their reach.

The market will continue its gradual ascent over time (fueled by population growth, productivity gains & technology). Before arriving at the next summit, we will have to cross valleys yet unknown. In time, we will reach peaks we can scarcely imagine today. Such is the journey to Mt. Market.

This post expands upon the maxima & minima framework introduced in Decoding Market Fluctuations.

Member discussion