When Markets Peak

Most global markets are at their all-time highs today. These moments feel like triumph, and also a test. Excitement and optimism collide with fear and uncertainty: Is this the peak? Should I lock in the gains? Or stay invested?

An analysis of market history offers valuable insights into the patterns of all-time highs and what they mean for investors.

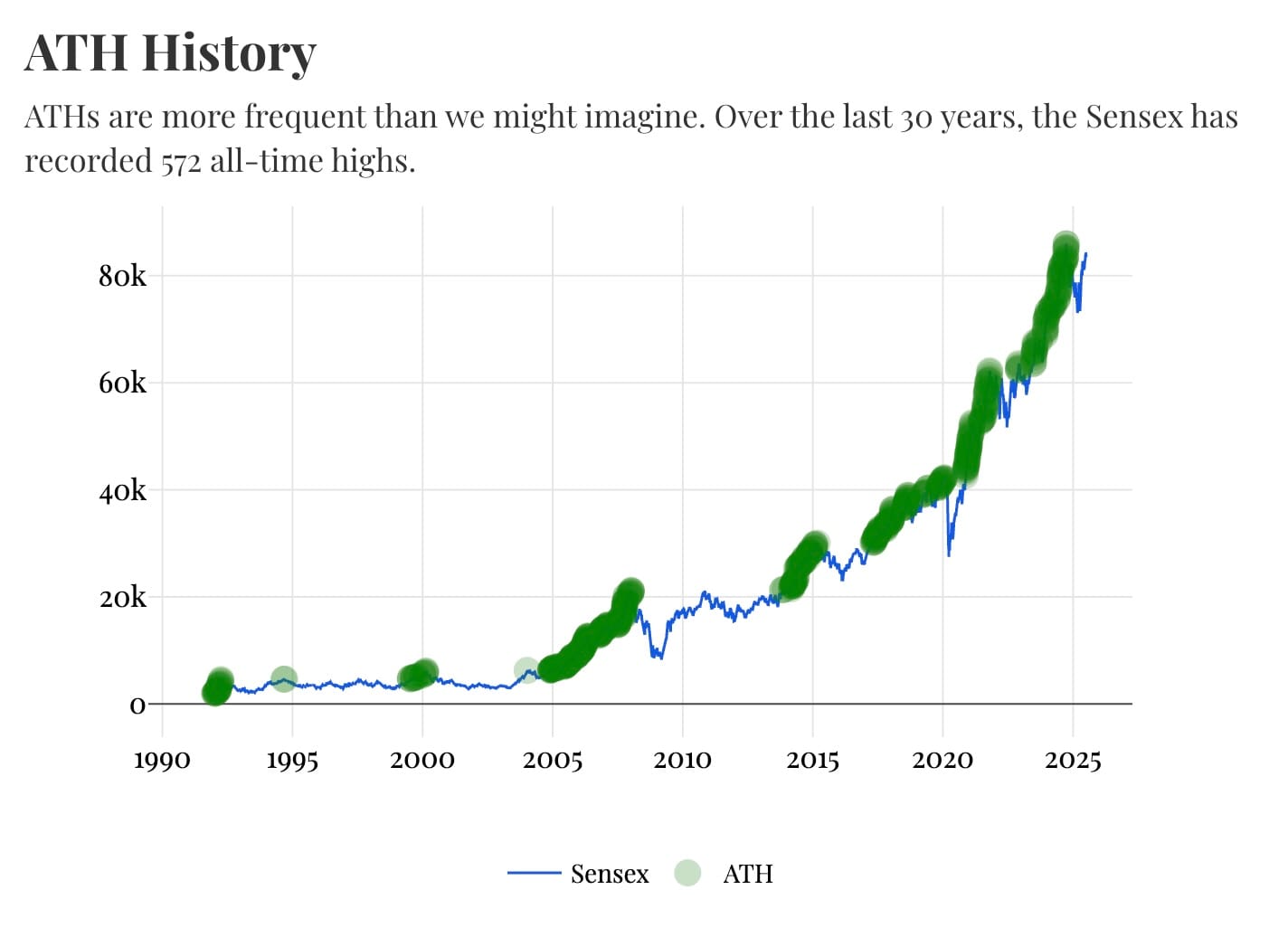

1. All-Time Highs Happen Often

Over the last 30 years, the market has reached all-time highs (ATH) nearly 600 times. Which means that these moments are neither rare nor alarming—they’re a natural part of the market’s long-term upward trend. As the chart below shows, ATHs appear frequently, making them common milestones in how markets move over time.

2. All-Time Highs Come in Cycles

The market doesn’t make highs in a straight line. Some years (bull markets) see frequent ATHs, while others (bear markets) may have none. However, history shows that after periods of quiet, the market tends to rebound with an abundance of highs.

As illustrated in the chart below, the annual frequency of ATHs varies significantly, highlighting how markets move in cycles. This underscores the importance of staying invested through the bad years to capture the critical high-growth periods.

3. Holding Is What Creates Wealth

Many investors are tempted to sell at all-time highs, fearing a market reversal. However, history shows that even if someone had bought the index (or a diversified portfolio) at previous ATHs, they would still have achieved gains over time.

The chart below illustrates this very well: the all-time highs of the past are merely a fraction of the current peak. This confirms that wealth is not created through frequent buying or selling but by staying invested. While resisting the urge to sell at every high can be difficult, it allows portfolio holdings the time and opportunity to reach their full growth potential.

Through the lens of Mt. Market, today’s all-time high is just one of many summits on a larger climb. While today’s peak will eventually be surpassed, it won’t happen without first encountering valleys and corrections along the way.

This perspective encourages investors to view all-time highs as milestones rather than natural signals to sell. Only by staying invested through market cycles can we benefit from future peaks and achieve significant long-term growth.

Related posts:

Member discussion